As a clergy you may not require to pay taxes on your house allowance although there are special circumstances that may dictate you do. This highlights the need for the clergy to have clarity on all matters housing allowance to know what to include in W-2 so as to take advantage of tax deductions. The first step of acquiring house allowance is to understand whom the relevant authorities term as a minister. Anyone licensed , ordained or commissioned to take on religious functions is recognized as the clergy by relevant authorities . More importantly to note is that for the housing allowance must be designated earlier , the amount quoted and clearly put forth before payment.

The thing about house allowance is that it must have all been spent on all things house. It should be approved by the leadership of the particular organization or the board and the approval made in writing. This allows for a better defense by the clergy were it to be challenged in the future. It is the relevant authorities that get to decide how much is just right to be given as house allowance. As long as it’s within the relevant authorities range whether fully dependent or with another job on the side housing allowance can be a hundred percent of the salary.

With commercial and vocational housing out of the way, buying, renting and maintaining a clergy’s house are all included in house allowance. Any inclusions in the house allowance can only be personal in nature. Other instances like mortgage payments, property taxes not included in mortgage payments, Insurance exclusive from mortgage payments, home owners dues as well as utilities can be included in the home allowance. For utilities , the clergy has to be able to provide a full estimate of home maintenance over and above what has been provided for by the religious organization.

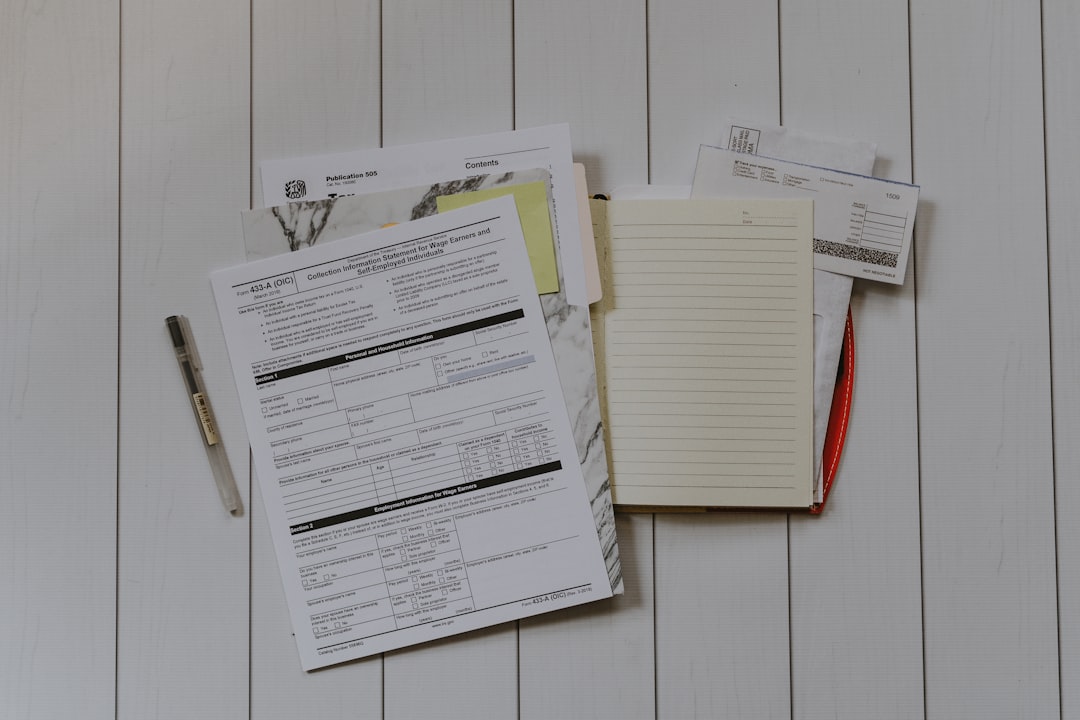

For auditing purposes when need be, the minister should provide top notch thorough records to support tax returns. The documents should remain in order in event their need arises. Seven years of bookkeeping is the standard for adequate defense of tax audits. What the clergy needs to do is provide an audit trail and receipts to support their expenditure. There are events that may see a minister pay tax on house allowance like spending less than was provided for house allowance or having a house allowance that is way more than the relevant authorities recommendation. Owing to the nature of tax preparation and changes in tax codes ministers are better placed on tax preparations with professionals who are well versed in these areas and others that are related.

Recent Comments